The oldest hospital in California — the only one serving the diverse population of Chinatown — now gone.

The local hospital that the community counted on just … closed. In as effort to make up for the loss, the building will be repurposed as a recreation center.

A two-year-old hospital with state of the art equipment went from chef-inspired meals to closure in the blink of an eye.

JOANNE FROGGE, BidMed President | I have liquidated more hospitals than one could imagine. I have walked the eerily quiet halls, the silence punctuated only by obstinately beeping equipment. It’s a rare opportunity to see a hospital completely devoid of patients and staff, yet looking like everyone just stepped away from their station.

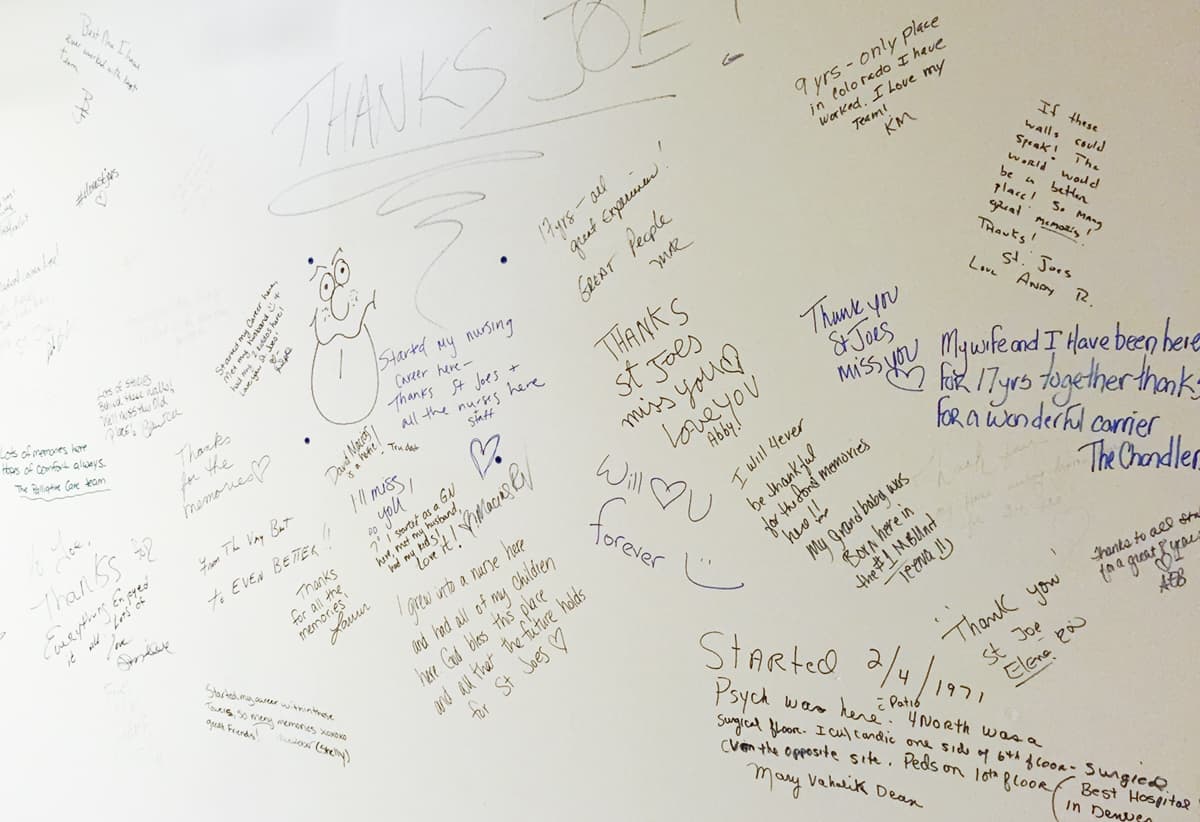

Messages are written on walls — reminders of a lifetime of memories experienced at that hospital. Patient white boards still display instructions, physician names, and goals for mom, like recognizing feeding cues with her baby. A beautiful white marble chapel serves as a consolidation area for equipment. For most seasoned hospital executives, this is a first-time experience in their career; but for me, it’s a typical project. The greatest assistance I can provide at this point is to guide them every step of the way, help maximize and recover the value that’s left, and empty their hospital. Even though I am in the business of closing down hospitals, it never feels right. The mission and vision statements are clearly emblazoned on the walls: to deliver the best care, relentlessly pursue excellent performance, and strive for continuous improvement and quality service. Where did these facilities go wrong?Cost Savings

Strategic Sourcing Costs

Strategic Sourcing Costs

- New and Refurbished Capital

- Purchased Services

- Medical and Surgical Consumables and Supplies

- Capital Equipment Service Contracts

Eliminate decision making inefficiencies using streamlined workflows

Eliminate decision making inefficiencies using streamlined workflows

Volume pricing discounts from vendor contract consolidation

Volume pricing discounts from vendor contract consolidation

Cost Avoidance

Additional costs that exceed evidence-based value

Additional costs that exceed evidence-based value

Denied reimbursements due to insurance credentialing errors

Denied reimbursements due to insurance credentialing errors

Fines resulting from compliance issues

Fines resulting from compliance issues

Unintended renewals and fees due to poor contract lifecycle management

Unintended renewals and fees due to poor contract lifecycle management

Unforeseen costs due to inadequate capital replacement planning

Unforeseen costs due to inadequate capital replacement planning

Revenue Opportunities

Maximize reimbursement rates using the same clinical evidence as Payers

Maximize reimbursement rates using the same clinical evidence as Payers

Expedite billing for new providers by shortening the enrollment and credentialing process

Expedite billing for new providers by shortening the enrollment and credentialing process

Fines resulting from compliance issues

Fines resulting from compliance issues

Increase returns from trade-ins and retired medical equipment

Increase returns from trade-ins and retired medical equipment